24+ How much borrow mortgage

If your relative doesnt agree with your terms you dont have to lend them money. The precise loan amount you can borrow from our panel of lenders does depend on various factors such as on your personal income your financial position credit ratings and what debts and commitments you currently have.

Investordaypresentation

Simply put our mortgage calculator takes into consideration how much you earn and whether youre buying on your own or with someone else.

. Low Down Payment Mortgage. 03 456 100 103. The amount we will lend depends on your circumstances the.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only. Note that your monthly mortgage payments. Lets presume you and your spouse have a combined total annual salary of 102200.

Applications are subject to status and lending criteria. How much can you borrow. Investment property mortgage rates can range from 50 to 875 basis points higher than rates on a primary home.

Mon to Sat 8am - 8pm and Sun 9am - 8pm. You need to know how much you comfortably afford to repay given your other expenses and without impacting your lifestyle too much. DCU service for the life of the loan Well service your loan as long as you have itNo need to worry about making payments to a different lender.

Customers and applicants can borrow anywhere from 100 to 35000 with repayments able to be made over the course of 3 to 24 months. 0800 48 24 48. Borrow from 8 to 30 years.

You can calculate your mortgage qualification based on income purchase price or total monthly payment. Cash out debt consolidation options available. Truliant Mortgage Services offers several mortgage options that allow you to put as little as 3 down.

This will depend on the amount of equity you have and your ability to qualify to carry the debt for your existing mortgage if any the home equity line of credit and the mortgage on your new home. Our mortgage calculator will give you an idea of how much you might be able to borrow. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

If half of each of your paychecks goes to your mortgage you still have only 24 mortgage based payments leaving two extra paychecks per year that do not apply to your mortgage. Because of this you likely have an additional months mortgage payment without realizing it. Monthly payments on a 200000 mortgage.

Truliant home mortgage loans are scalable to your situation. Please get in touch over the phone or visit us in branch. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

But when you advance a. See the example below. A reverse mortgage is a type of mortgage in which a homeowner can borrow money against the value of his or her home receiving funds in the form of a fixed monthly payment or a.

Working out how much you could borrow is an important part of choosing your new home and home loan. This provides you a ballpark estimate of how. You can also input your spouses income if you intend to obtain a joint application for the mortgage.

Applicants must be UK residents aged 18 or over. Look at different family mortgage loan agreements for reference. Family loan agreement 24 18 KB family loan agreement 25 39 KB family loan agreement 26 12 KB.

There is no other option than to borrow from a family member. Jumbo mortgages are for loans starting at 647201 up to 2000000. How much could I borrow.

At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 95483 a month while a 15-year term might cost a month. Pay off higher interest rate credit cards pay for college tuition. Overpayment calculator Find out how much you could save by overpaying on your mortgage.

You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. States that it can take 12 months to 24 months before your credit score improves. Existing first direct customers.

Consistent payments Youll have the same principal and interest payment for the life of the loanFixed-Rate Home Equity loans are available in all 50 states. Over 170000 positive reviews with an A rating with BBB. This calculator is for illustrative purposes only.

Access your account information online 24 hours a day with our mortgage portal. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. Heres a breakdown of what you might face monthly in interest and over the life of a 200000 mortgage.

We offer up to 75 - 90 on the mortgage depending on the cost of the home. Contact New American Funding today to see how much you can save. Fixed-Rate Home Equity Loans.

When you take out a policy loan youre not removing money from. You can use the above calculator to estimate how much you can borrow based on your salary. Our affordability and maximum home loan calculators can help you work this out.

When mortgage rates are low as they were in much of 2020 and 2021 homeowners wanting to borrow money against that equity for big expenses took advantage of cash-out refinances in which you take. Yet you only have to make 12 payments one per month on your mortgage. 18001 0800 096 9527.

However we may be able to achieve a bridge loan through the use of a home equity line of credit on the house you will be selling. Your total interest on a 600000 mortgage. How much you can borrow from a life insurance policy varies by insurer but the maximum policy loan amount is typically at least 90 of the cash value with no minimum amount.

0800 096 9527 Relay UK. As an example if mortgage rates for a 30-year fixed-rate mortgage on an owner-occupied home are averaging about 325 you might expect a 30-year investment property loan to have a 375 to 4125 interest rate. Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term.

Thats about two-thirds of what you borrowed in interestIf you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage.

How To Find Your Student Loan Balance Forbes Advisor

Pin On Data Vis

Pricing Truth Concepts

Loan Proposal 11 Examples Format Pdf Examples

Free 10 Loan Application Review Forms In Pdf Ms Word Rtf

What Is A Personal Loan And How Does It Work In 2022 Personal Loans Financial Management Balance Transfer Credit Cards

Borrow Loan Company Responsive Wordpress Theme Loan Company Amortization Schedule The Borrowers

Loan Proposal 11 Examples Format Pdf Examples

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

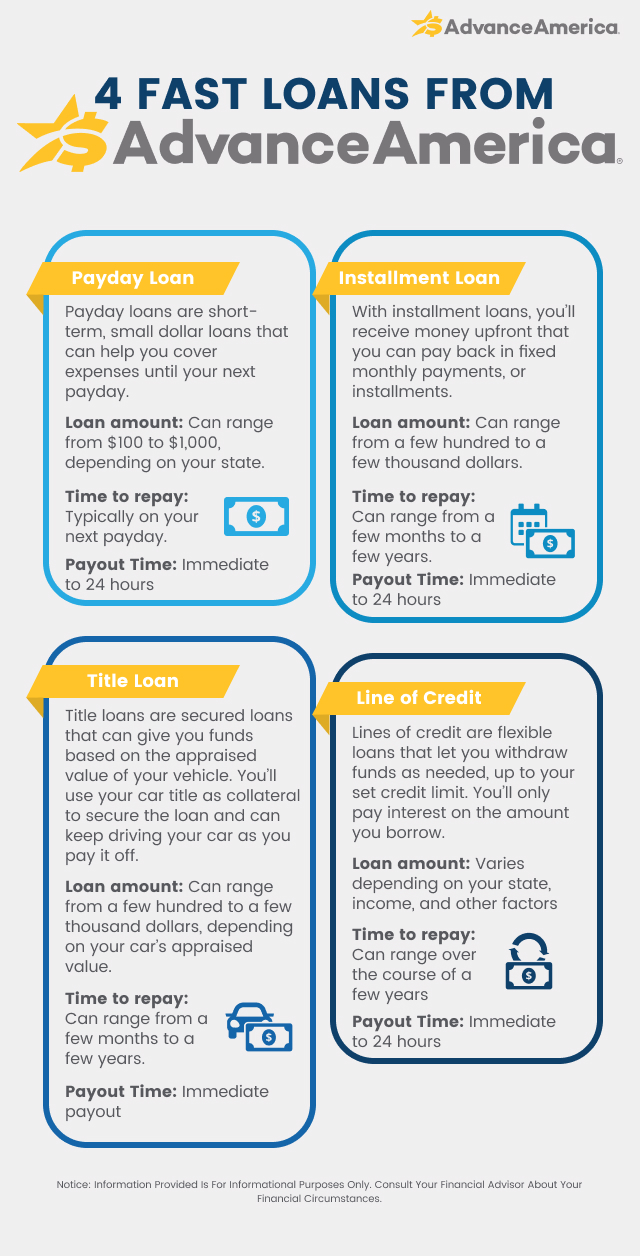

How To Borrow Money Fast Money Loans Advance America

Debt To Income Ratio Advance America

Loan Receipt 6 Examples Format Pdf Examples

What Is Financial Literacy Advance America

Should I Pay Off My Loan Early Advance America

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

Pricing Truth Concepts

Loan Receipt 6 Examples Format Pdf Examples